What does the data say? The impact of COVID-19 on rental payments

This blog post relates to Rockend, one of our previous brands. For more information please read the press release.

There is no question that COVID-19 has had a significant impact on the property management industry. Inspections have gone virtual, offices have closed, tenants are struggling to pay rent, landlords are struggling to pay their mortgages, and more than ever agencies are looking at moving to cloud-based property management software. And if you didn’t know before, you probably know how to provide a rent concession by now. But what size concessions are agencies giving? And how have key metrics such as vacancy rates and arrears changed with so many tenants in strife?

I recently hosted a webinar on covering all this and more with Paul Wahltuch, Head of Innovation at MRI, and special guest Tim McKibbin, CEO of REINSW. Together we discussed the latest data from MRI on rent concessions, vacancy rates, and arrears. With over 50% of rental properties in Australia managed by agencies using Rest Professional and Property Tree, MRI is in a unique position to show exactly how the data has changed in these key areas during COVID-19.

Let’s take a look at the key takeaways of the session to help us understand what the data is telling us.

How rental concessions have changed

Unlike the market mechanism that helps us determine the correct rent for a property, a mechanism doesn’t exist to determine a fair concession as concession requests are not made in public forums. So there’s no easy way to see if the concessions your giving your tenants are similar to the concessions the agency round the corner is giving.

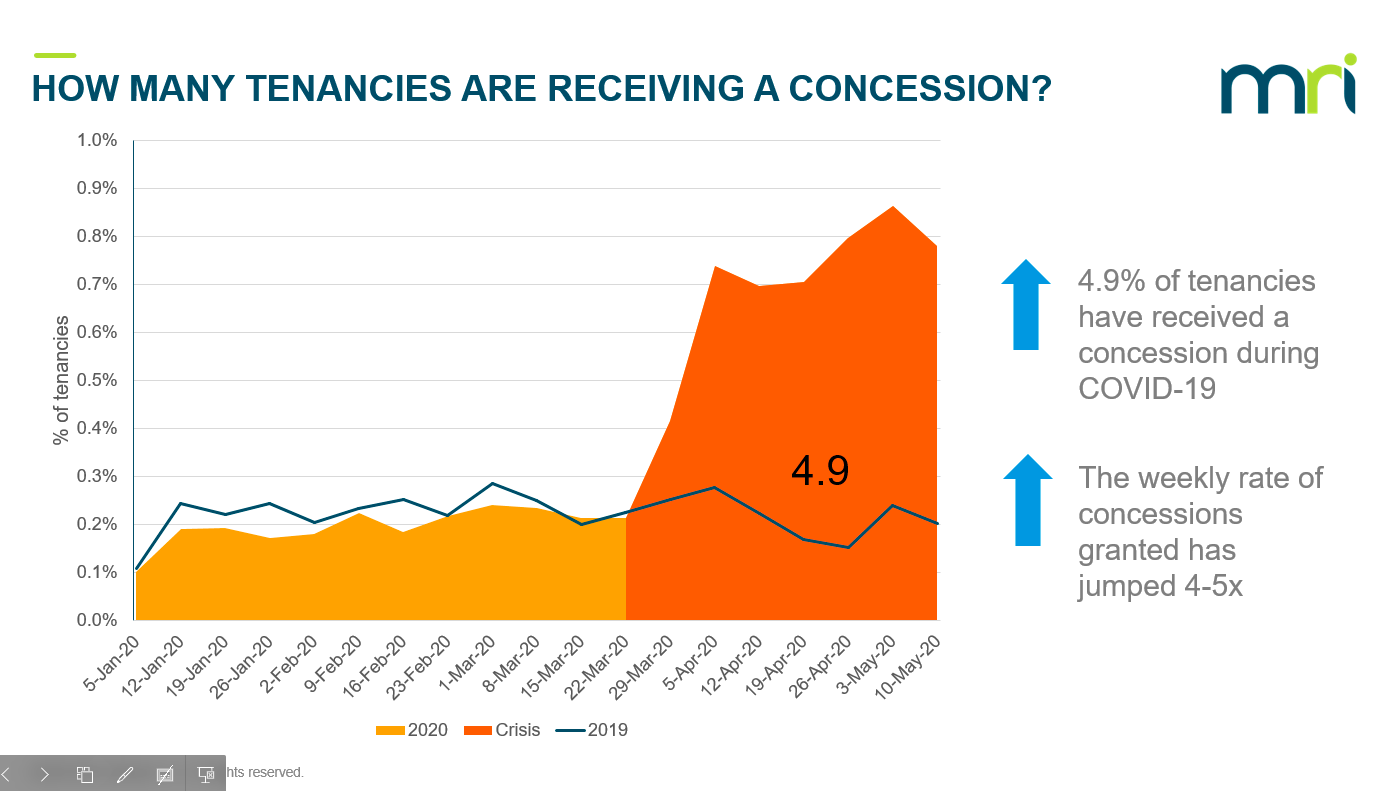

The number of concessions given has increased

With an ongoing crisis, it is to be expected that the number of concessions given will increase. The data reflected this – although not to the degree some may have expected, with 4.9% of all tenancies receiving some kind of concession since COVID-19 hit towards the end of March 2020. To put it in perspective, that’s 1 in 20 properties 4-5 times more than in the previous period.

If this seems low to you, it might be but it could be too early to conclude if the rate of rental concessions won’t continue to increase in the near future.

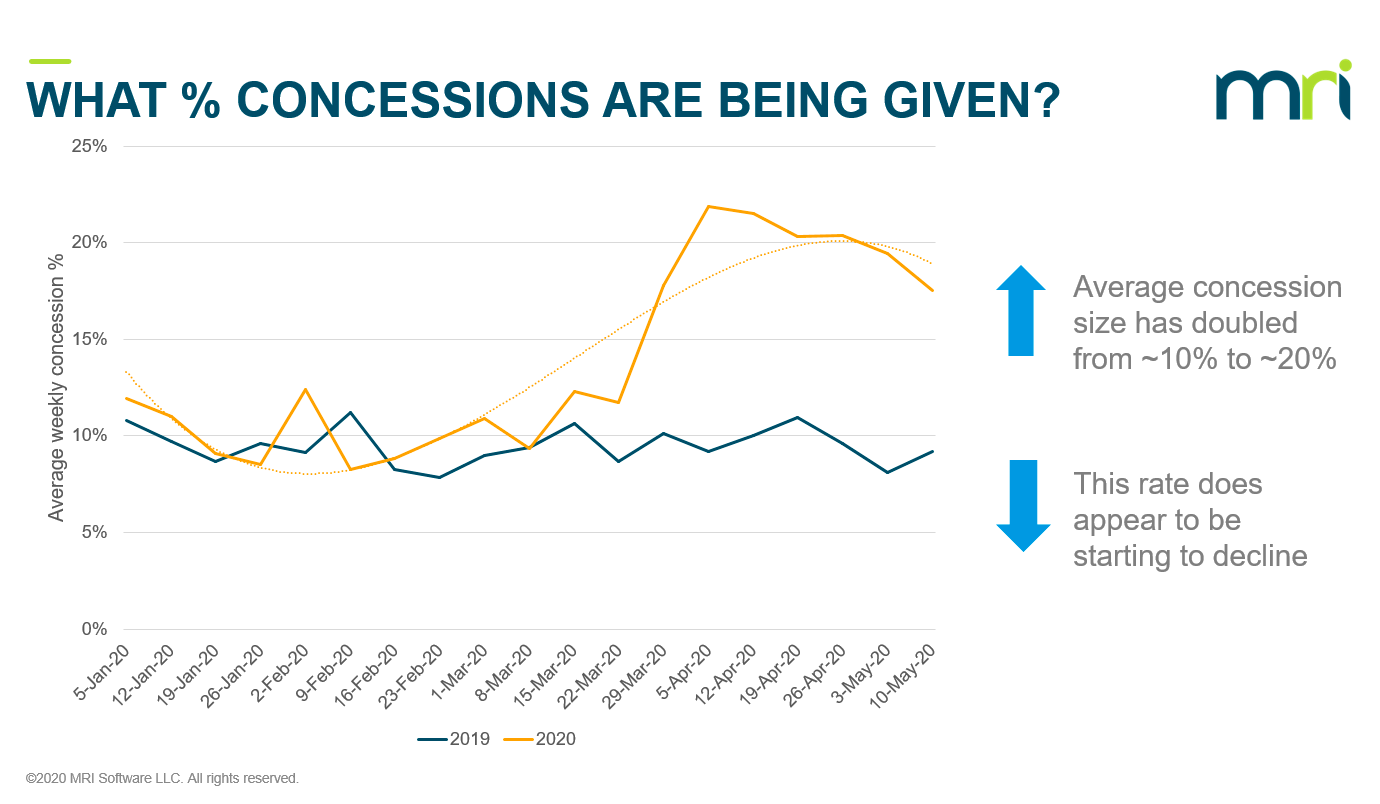

The size of concessions given has doubled

As for the size of these concessions – the average rent concession has doubled from ~10% earlier in the year to~20% in April. It’s also useful to note that concessions much higher than this are exetremly rare – so if you’re negotiating with a tenant right now, this data could help provide a “market rate” in the same way you look at market rent to determine the cost of renting a property.

On types of rent concessions: Abatement vs deferral

We also discussed the importance of determining which type of concession should be given for a unique set of owners/tenants to ensure fairness and sound business practice.

Tim McKibbon told us communication and information gathering will help determine whether an abatement or deferral is suitable in a given set of circumstances. REINSW are supporting property managers by providing a suite of documents that can help streamline the process, and encouraging agencies to make the decision on a case-by-case basis. He also highlighted the importance of gathering the required documentation to prove a tenant has a genuine need for a concession due to COVID-19.

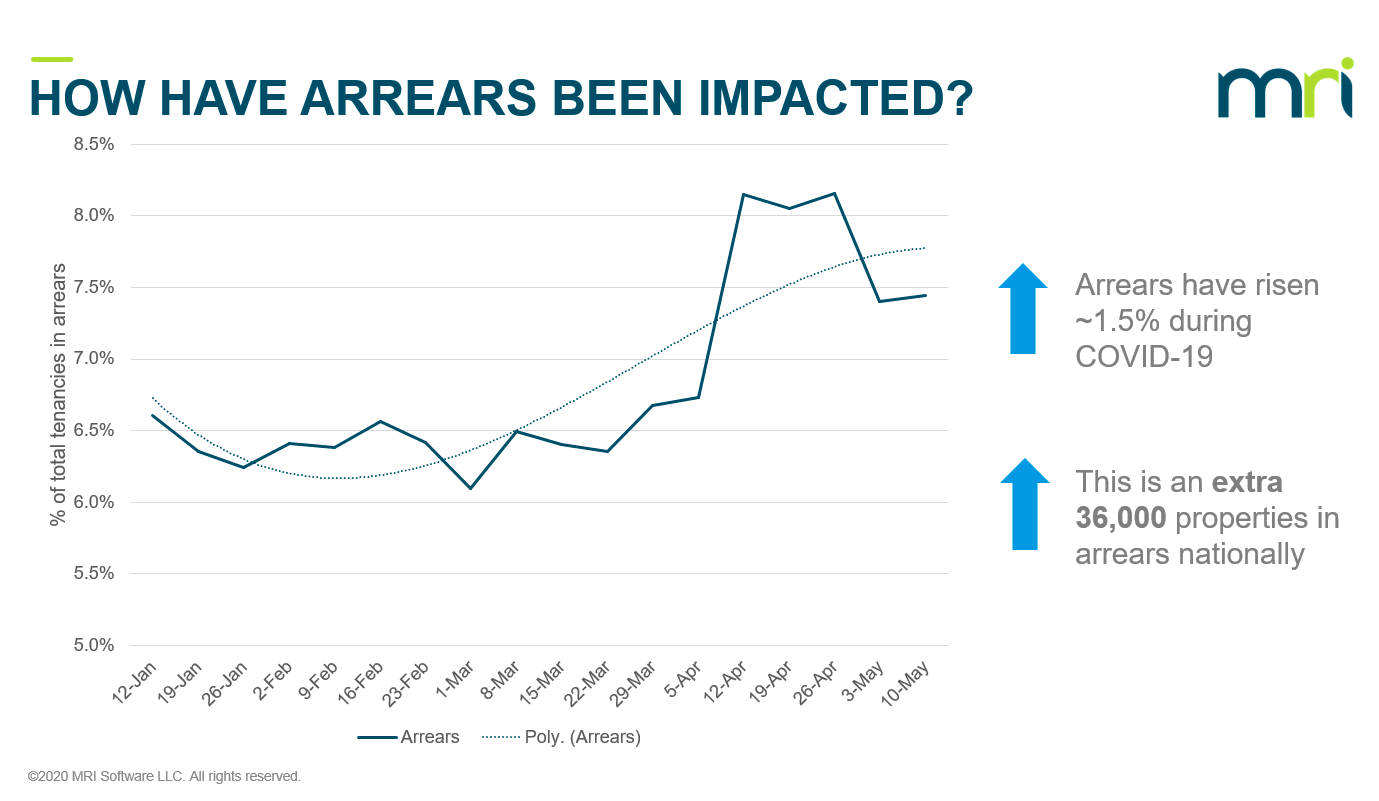

How arrears have changed

The number of properties in arrears has risen from 6.5% to 8%. That 1.5% might look small, but it’s an increase of 36,000 properties nationally. Interestingly, a breakdown of the data showed that a large portion of these arrears are incurred by people who were already in arrears even before the crisis. While this is not a dramatic surge, we have yet to see how this will pan out in the coming months as the pandemic continues to affect the livelihood of many people. The waivers and deferments being given right now will also impact the arrears data come September and October, as tenants begin to start paying back the amounts accrued. It is likely that tenants who are already in trouble will have to start paying 10 – 20% on top of their previous rent once this is over – particularly as the government removes JobKeeper and JobSeeker payments.

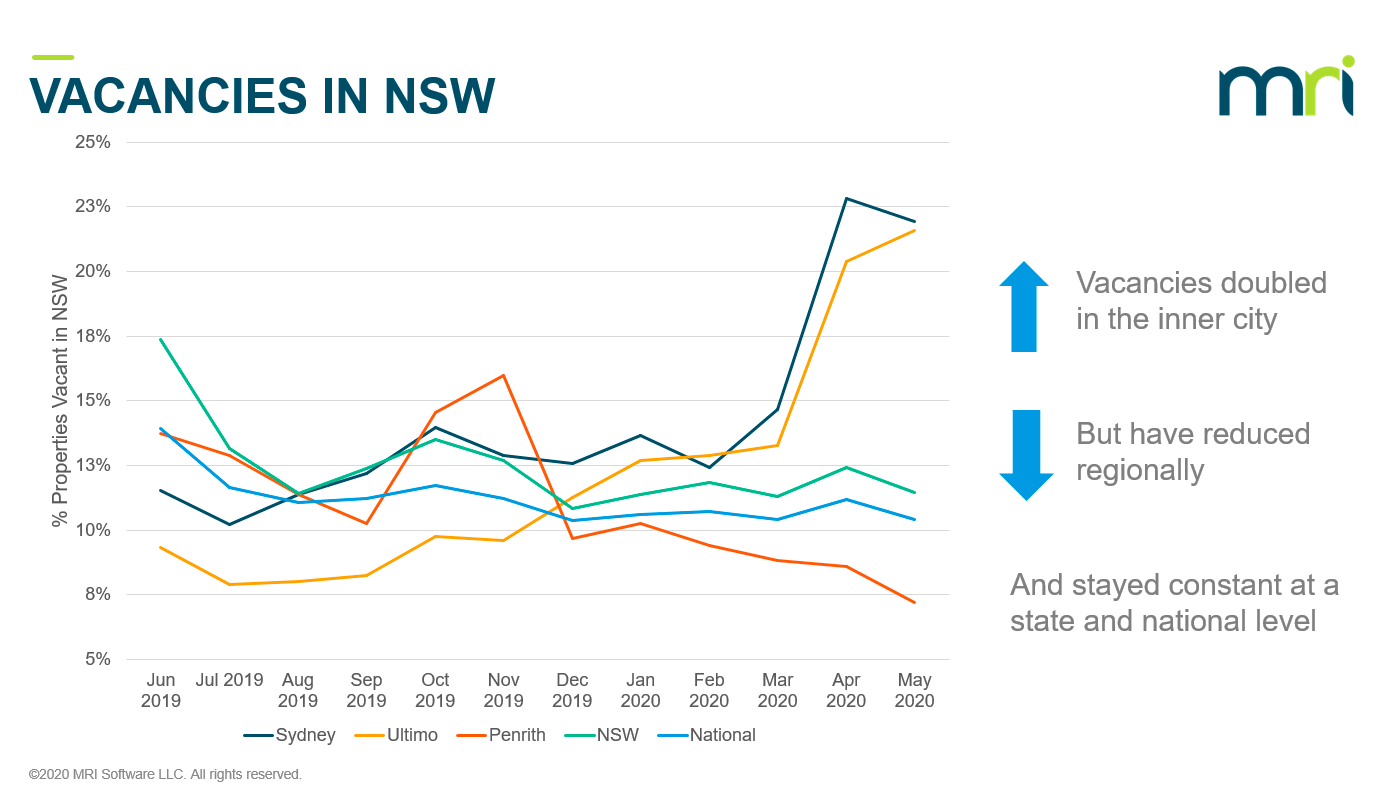

How vacancy rates have changed

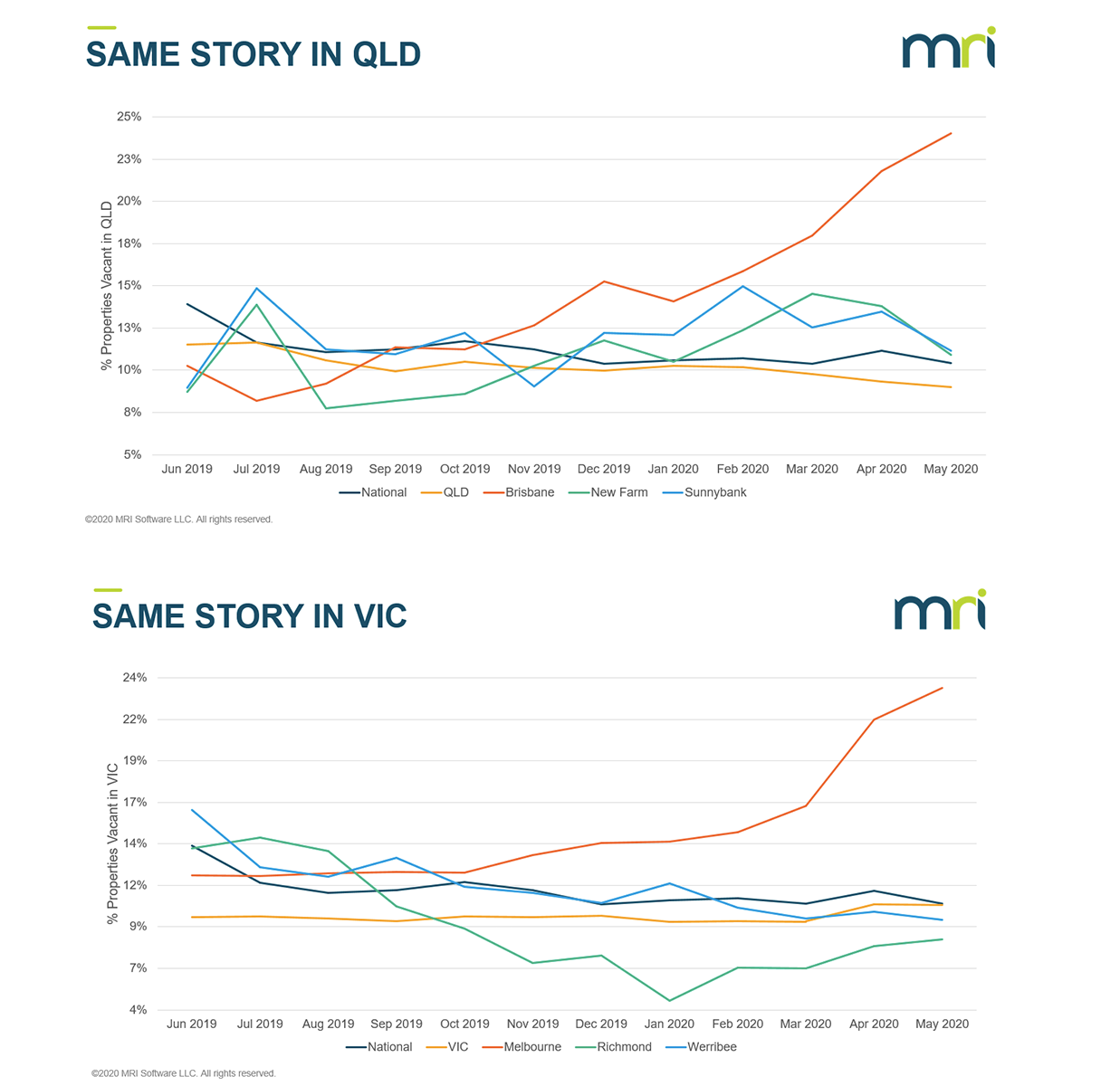

Vacancy rates were a surprise, staying steady compared to the previous levels across all states. That is not to say there hasn’t been an impact – vacancy rates have doubled in inner city areas like Ultimo and Sydney CBD whilst suburbs further out have actually shown a decline. The same trend can be seen in other states around Australia, like Richmond in Melbourne and New Farm in Brisbane.

A couple of factors explain this data. Travel restrictions have essentially killed the holiday and short-term rental market, whilst sending international residents – including many students – back to their home countries. It’s no coincidence then that inner city suburbs, with higher populations in these demographics, are struggling the most. Conversely, shelter in place orders have probably caused Australian residents to put off moving places for the time, so it makes sense that areas with low international residents are seeing a decline in vacancy rates.

A webinar attendee also shared an insight on how lease renewals during the crisis can affect vacancy rates and ultimately market prices. Whilst tenants might not request concessions, many will look to find cheaper rent as their lease comes up for renewal. If landlords aren’t willing to budge, then we may see many moving out, putting downward pressure on rents so that it becomes a renters market. Paul added that this early on, we can see there’s only been about a $7-8 decrease in average rent, but the impact of that on the industry as a whole is around $60 million.

Key takeaways

Here’s what we’ve learned from this online discussion:

1. Concessions are increasing in both number and size

As the pandemic crisis continues and affects the financial stability of tenants, the trend shows that more concessions will be given. Rent concession sizes are also expected to increase.

2. Vacancies are increasing in vulnerable areas

Inner cities are at risk for higher vacancy rates than other suburbs. Travel restrictions and market prices are driving factors for changes in vacancies during this crisis.

3. Rental prices are declining

We’ve seen that when applied to current property management fees, a small decline in rental price can have a great impact in the industry, and it is very possible that this trend will continue as tenants take control of the market.

4. Extreme effects of the crisis are localised at the moment

Extreme impacts of the crisis are being felt in certain areas. However, it’s too early to tell if a greater impact will materialise on a national level.

5. Be cautious – we don’t know what’s next, so protect yourself

As all of us are navigating unchartered territories with this pandemic, it is important to arm ourselves with the right information. Use the available data to make more informed decisions, especially when having conversations about concession amounts and type.

Disclaimer: This information has been provided as a discussion mechanism. It is not intended to be used or relied upon for decision making or investment purposes. MRI assumes no warranties and takes no responsibility for the accuracy, legality, or reliability of the information.

Voice of the Strata Manager Report – 2023 Australian Edition

Strata management is a role of growing importance, value and influence in the Australian property landscape. Strata managers are responsible not just for managing the assets, maintenance, compliance and safety of Australia’s residences, but through t…