Guide to NZ EOFY in Rest Professional

This blog post relates to Rockend, one of our previous brands. For more information please read the press release.

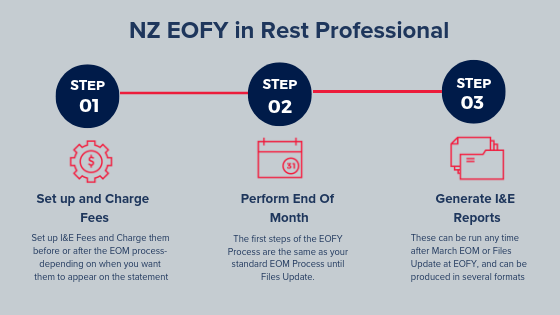

In New Zealand, you are required to rollover your financial year on 1st April to include all transactions on your bank statement up to and including 31st March. We understand that it can be a stressful time of the year, so we want to make the process easy for you and your team by putting together this step-by-step EOFY guide in Rest Professional. Please take note that the process will vary slightly if you run your EOM process prior to EOFY (April 1st).

Charging the I&E Fees

If you are charging Income and Expenditure fees and would like these fees displayed on the EOM statement for the month of March, you need to set up and charge these fees prior to commencing the EOM process. If you haven’t set this up yet, here is a detailed guide to set up the I&E fee.

If you want the I&E fee to display on the April Statement, charge the fee after the EOM procedure for March.

Before charging the fees, Ensure you have a current backup and rename it to before.ie.charge.dat.zip. If you post charges in error, you can restore to this backup rather then having to reverse the outstanding disbursements.

Confirm the fee amounts and owners to be charged.

1. Go to Transactions> Owner one-off Charge

2. Print a list of the owners and the fees entered on the Owners Taxes & Charges tab.

3. Check that the list of owners and corresponding amounts are correct.

Create disbursement for Income & Expenditure Fee

1. Go to Transactions> Owner one-off Charge

2. Click Process

3. Enter the Internal Account i.e. AAINCEXP and press Enter

4. Enter a Description. This description will be displayed on your owner’s statements

5. Enter the Account code

6. Click OK and then Click Yes

When you Process Outstanding Disbursements, the charges will be posted for all owners with sufficient funds and the GST if applicable will be posted to the AAGST account.

Processing End of Month/ EOFY

1. The first steps of the EOFY process are the same as your standard End of Month process. Complete these steps as usual until you reach the Files Update process.

2. At the Files Update Screen, ensure Clear Year to Date (YTD) Data is ticked.

NOTE: If you run your End of Month process and Files Update prior the 1st April, do not complete another Files Update on 1st April, as this will compromise your history. You have already closed off the month of March.

End of Month prior to EOFY

If you closed off before the 1st April, your auditors may require you to create a Current Backup renamed to EOFY 31 March YYYY, complete a successful bank reconciliation including all transactions on your bank statements and print all reports on 1st April.

Generate I&E Reports

Income and Expenditure summaries can be produced in several formats. These instructions step you through the Income and Expenditure options that are most commonly used.

How to Display Figures as GST Exclusive (Commercial Properties Only)

1. Ensure all users are logged out of Rest Professional. You can check this by going to Other > Active User List

2. Go to Other > Utilities > System Options > Other Tab

3. Tick Show Income & Expenditure figures GST Exclusive checkbox. Click OK-F12

How to Produce the Income and Expenditure Report

1. Go to Reports > Owner > Income & Expenditure Reports > Yearly Summaries

2. Select criteria as required:

– Account Types – When generating this report, you can now filter for Owners with Charges entered on the Owner Details, which will allow you to only print/email reports for owners who are charged for this report

– Sort Order – You have the option to sort data in the report according to owner or property.

– Make the appropriate selection from the Sort Order dropdown list

3. Click Print-F12

How to Produce Yearly Summaries by Statement (For Clearing Statement Database)

If you are using clearing statements, there is an additional end of financial year report that you may wish to run. The Yearly Summary by Statement gives you a list of statements run during the financial year and a summary of the rent, disbursements, fees, etc. for each statement.

1. Go to Reports > Owner > Income & Expenditure Reports > Yearly Summaries by Statement

2. Select the criteria:

– Account Types – When generating this report, you can now filter for Owners with Charges entered on the Owner Details, which will allow you to only print/email reports for owners who are charged for this report

– Show Disbursements – When selected, the report itemises the disbursements shown on each statement.

– Send via e-mail – If selected, the Yearly Summary by Statement is emailed to owners who have been set up with the option to e-mail owner statements. If the global option to Print emailed owner statements has been selected, the summaries are printed as well as emailed.

3. Click Print-F-12

Need more EOFY information? Just go to the Rest Professional Knowledgebase. We have an entire section devoted to EOFY in NZ complete with step by step guides and FAQs. You can also call our support team at 09 909 7093 if you need further instructions in the EOFY process.

Voice of the Strata Manager Report – 2023 Australian Edition

Strata management is a role of growing importance, value and influence in the Australian property landscape. Strata managers are responsible not just for managing the assets, maintenance, compliance and safety of Australia’s residences, but through t…